does idaho tax pensions and social security

Keep in mind this list doesnt necessarily mean these states are the most tax friendly or best states to retire as some states still have other state income taxes sales tax or 401k or pension taxes. Those who earn more than that might qualify for the exemption if theyre disabled.

Medicare Expert The Top 5 Medigap Plans Baby Boomers Don T Know About Newsweek Medicare How To Plan Medicare Supplement Plans

February 7 2022 Post category.

. New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Part 1 Age Disability and Filing status.

Most pension benefits are currently taxable on your Idaho state income tax return. However according to Idaho instructions Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Hawaii does not tax Social Security benefits.

Exceptions include Canadian Social Security benefits OAS QPP. To make this. Now that they are collecting Social Security the tax calculation requires an extra step.

14 Ways the Proposed Law Could Change. As they work teachers and their employers must contribute into the plan. However according to Idaho instructions Idaho allows for a.

Additionally the states property and sales taxes are relatively low. Is brooklyn bigger than manhattan. 800-972-7660 or taxidahogov Retirement Benefits exclusion.

Other forms of retirement income such as from a 401k or an IRA are taxed at rates ranging from 100 to 650 the states normal income tax levels. Overview of Idaho Retirement Tax Friendliness. Pension from out-of-Idaho job now moved to Idaho.

Does idaho tax government pensions. Social Security Benefits. Does idaho tax pensions from other states.

800-732-8866 or Illinois Tax Department Exclusion for qualifying retirement plans. If your income by that definition is at least 32000 if youre married filing jointly or 25000 for all other filing statuses up to 50 of your Social Security benefits could be taxed by. The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old.

For more information see the Hawaii State Tax Guide for Retirees. As a resident of Idaho all military retirement amounts included in your federal return are also taxable on your Idaho return. Social Security retirement benefits are not taxed at the state level in Idaho.

February 7 2022. The state taxes all income except Social Security and Railroad Retirement benefits and its top tax rate of 6 65 before 2022 kicks in at a relatively low. Most pension benefits are currently taxable on your Idaho state income tax return.

Federal tax code where the taxable portion of Social Security income depends on two factors. 52 rows Employer funded pension plans exempt these self-funded plans may be fully or partly taxable. A taxpayers filing status and the size of their combined income adjusted.

Overview of Idaho Retirement Tax Friendliness. Oop vs functional vs procedural oop vs functional vs procedural. Idaho taxes are no small potatoes.

For more information see the Hawaii State Tax Guide for Retirees. The federal government does tax up to 85 of social security. Nike x sacai vaporwaffle stockx Post comments.

How Much Does Idahos Teacher Pension Plan Cost. States That Don T Tax Social Security. If Sam does not want taxes withheld from his pension instead he could make quarterly tax payments of 647 on April 15 June 15 September 15 of the 2020 tax year and January 15 of the following year.

The federal government does tax up to 85 of social security benefits depending on your income but 38 states tax exempt social security income. Missouri exempts Social Security benefits from state tax provided that the individual is age 62 or older and has adjusted gross income of less than 100000 if married and filing jointly or 85000 for all other filing statuses. Does idaho tax government pensions.

Those contribution rates are set by the state legislature and can change year-to-year. Exceptions include Canadian Social Security benefits OAS QPP and. She became a resident of California and receives pension income from a job she had in Idaho.

In 2018 teachers contributed 704 percent of their salary to the pension fund while the state contributed 1199 percent. 800-732-8866 or Illinois Tax Department Exclusion for qualifying retirement plans. Most pension benefits are currently taxable on your Idaho state income tax return.

Even though the pension income is from an Idaho source federal law prevents Idaho from taxing it.

/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)

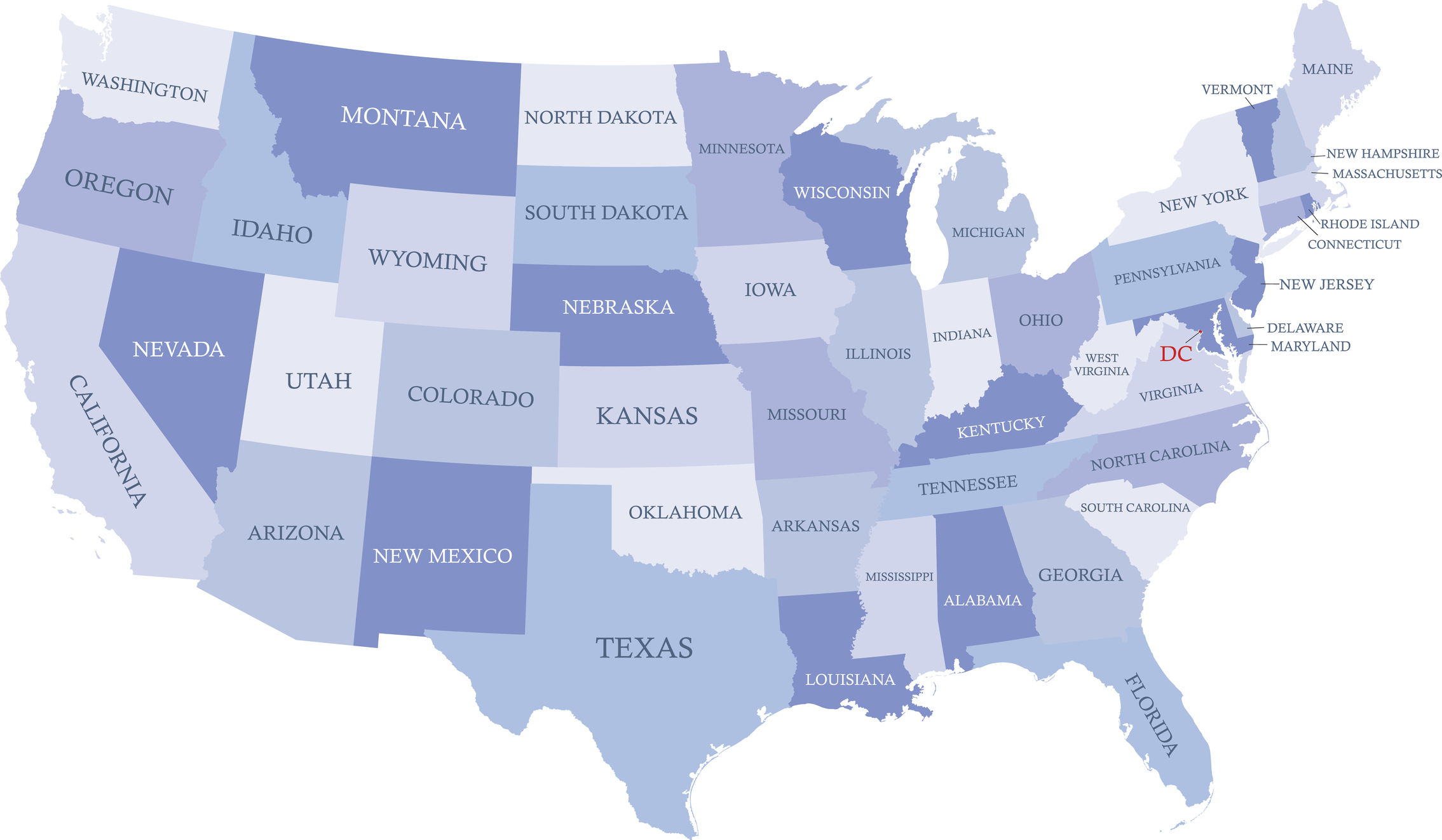

Which States Don T Tax Social Security Benefits

Watchdog Reports Reveal Problems At The Strained Underfunded Social Security Administration Pbs Newshour

Idaho Is Quickly Becoming A Popular Retirement Destination Attracting Seniors From All Over The Country The Low Crime Rate And Idaho Places To Go Retirement

When Will Ssi Checks Be Deposited For January As Usa

Usa Finance And Payments 2 753 Monthly Check Tax Deadline Gas Stimulus Check 8 April As Usa

Are There Taxes On Social Security For Seniors Updated For 2022 Aginginplace Org

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

All The States That Don T Tax Social Security Gobankingrates

Social Security Benefits Big Cola Increase Due To Inflation Money

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

15 States With The Lowest Social Security Benefit The Motley Fool

13 States That Tax Social Security Income The Motley Fool

How Much Is The Average Social Security Benefit In Every State Simplywise

A Rundown Of Social Security Monthly Benefit Increases For Retired And Ssi Beneficiari Social Security Benefits Social Security Disability Social Security Card

15 States With The Lowest Social Security Benefit The Motley Fool

Idaho Affidavit Verifying Income Form Income Idaho Form

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group